Bitcoin: Getting started made easy!

All beginnings are difficult. But getting started in an area as complex as Bitcoin and cryptocurrencies is particularly difficult. Although there is now a lot of well-prepared information to be found, this flood of information can also be very daunting for complete beginners.

In this short guide for beginners, we want to make it easy for you to get started and give you all the information you need to enter the world of Bitcoin & Co. In ten short sections, you will be equipped with the knowledge you need to get started.

1 What is Bitcoin?

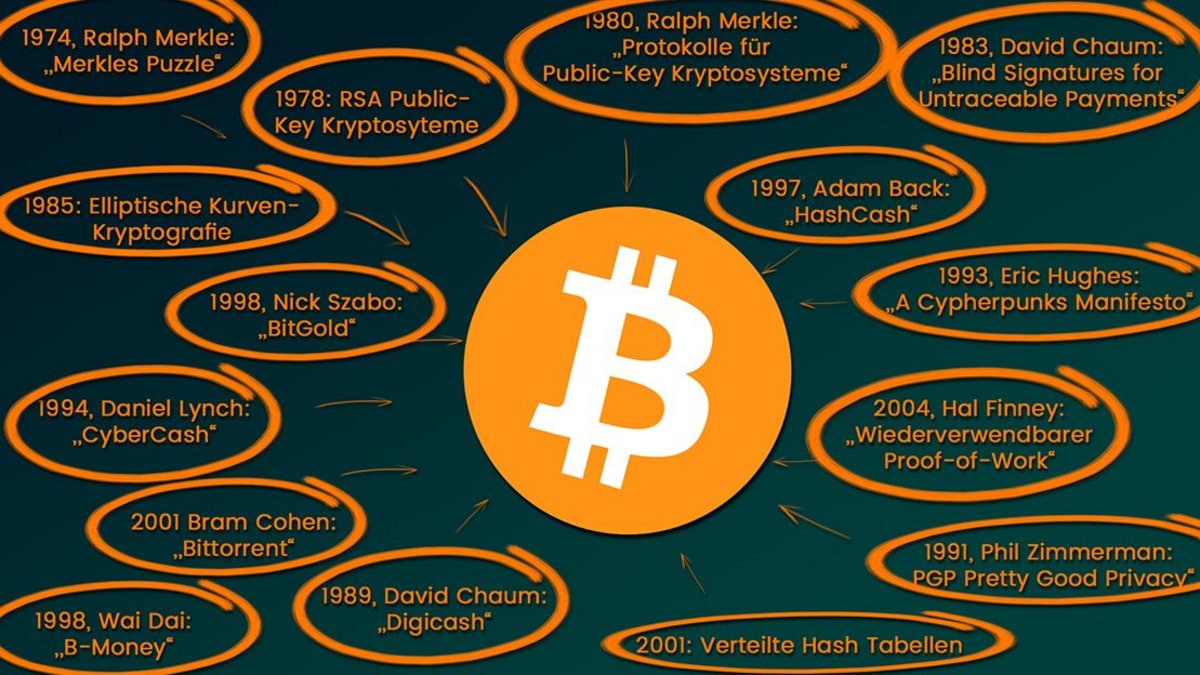

Bitcoin is often referred to as the first digital money or the first cryptocurrency . Strictly speaking, however, this is not correct, as the first cryptocurrencies were conceived as early as the 1990s. Unfortunately, however, these struggled with various problems that affected their security and usability. The inventor of Bitcoin, Satoshi Nakamoto, succeeded in solving these problems and making Bitcoin the world's first secure and limited digital asset .

As Bitcoin has numerous positive characteristics, many people see it as a technology that is not only capable of adding another asset class to the existing ones, but also represents a revolution in the existing monetary system.

2 What problem does Bitcoin solve?

Both in the established media and on social media, one reads again and again in connection with Bitcoin that it is used by criminals to process fast and anonymous transactions and that it was invented as a kind of "magic internet money".

However, these kinds of statements do not do justice in the slightest to Satoshi Nakamoto's ingenious invention and the problems that Bitcoin solves.

Bitcoin was not invented to replace PayPal, Visa or Mastercard with a faster and more anonymous system.

Bitcoin was created to provide a secure, free, non-manipulable and uncensorable alternative to the world's existing monetary systems. In an increasingly digitized and globalized world, Bitcoin provides the infrastructure for a globally available and secure monetary network.

Due to individual and environmental factors, around 38% of the world's adult population has no access to the banking or financial system (keyword:Financial inclusion). In some countries, for example, people are denied access due to their social status.

The Bitcoin network offers a solution to this problem. It works worldwide and is freely accessible to every individual and you don't have to ask anyone for permission.

Today's monetary systems (e.g. the euro or dollar) can be manipulated at will by central banks and money transfers can be censored by commercial banks ("You are not allowed to make this transfer"). The constant printing of money by monetary authorities leads to the existing money supply being diluted and the savings of citizens slowly melting away. Bitcoin also offers a solution to this problem, as the money supply of a maximum of just under 21,000,000 BTC is unchangeable.

The problem that is primarily solved by the Bitcoin network is the problem of digital scarcity. Everyone knows it: the files on a computer can be easily copied with just a few mouse clicks. In principle, digital money could therefore also simply be duplicated, which would also lead to an unintentional expansion of the money supply and the balances of all other participants would thus become smaller in proportion.

Satoshi Nakamoto, however, has succeeded in creating a system which, throughsophisticated mechanismscan guarantee digital scarcity. It is impossible to copy a Bitcoin and expand the fixed money supply. How exactly these mechanisms work is not important for starters. The only important thing is that they work!

3. what criticism & dangers are there?

When it comes to negative criticism and possible dangers, you can hear a wide variety of theories about Bitcoin. At this point, we would like to list the most important ones and make a brief statement about them. All of these "problems" have already been discussed many times in recent years and there are numerous articles and videos on each of the "problems" mentioned. Nevertheless, we would like to give you a brief introduction.

- Governments can ban Bitcoin

→ NO! Bitcoin is basically nothing more than software or a network that is distributed all over the world. It would be comparable to wanting to ban the internet. It is simply not possible. Only local access to the network can be banned or regulated. But it is more than unlikely that this will happen worldwide and at the same time. In fact, many countries currently see Bitcoin as an opportunity rather than a threat. - Only criminals use Bitcoin

→ NO! In the initial phase of the Bitcoin network, criminals were indeed a not insignificant proportion of users. However, the entire system is now relatively heavily regulated and not really anonymous. The majority of users today are honest citizens and legal institutions. Even large companies such as PayPal or BlackRock now rely on Bitcoin. - Bitcoin has no intrinsic value

→ There is no such thing as "intrinsic value". Value is always created by people who attach value to something, e.g. because they can use it for industrial processing. For many millions of people in this world, however, a free and uncensorable monetary system is of greater value than, for example, an industrial metal. - A Bitcoin transaction wastes a lot of electricity

→ It is true that a lot of electricity flows into the Bitcoin network, but this energy is used to secure the network and protect it from attacks of all kinds. The energy is therefore not wasted but used to secure a global and free monetary system. Compared to existing monetary systems, this energy is only a fraction and currently over 50% of it comes from renewable energy sources. Furthermore, Bitcoin does not necessarily require "a lot of electricity", but rather "high costs". If electricity were to become more expensive overall, the network would also need to consume less power to guarantee the same level of security. - Quantum computers will destroy Bitcoin

→ Very unlikely. Quantum computers are not really suitable for breaking the network's encryption methods in the foreseeable future. As soon as this would even begin to become a problem, the encryption methods in the Bitcoin system could be adapted accordingly by a joint decision of the network participants. Quantum computers are therefore not a problem. - A deflationary currency cannot work

→ A person who has been taught all their life that inflation is a good thing finds it difficult to accept the idea that a deflationary system could also work. In fact, humanity's mindset would first have to adapt accordingly. But even then, people would continue to produce and consume. However, the increase in the value of money would lead to more conscious consumption and higher quality products. Bitcoin would therefore have a positive impact on our throwaway society and therefore also on our environment. - 21 million Bitcoin are too few for the entire world

→ According to the rules currently set out in the Bitcoin protocol, each individual Bitcoin can be divided into 100 million sub-units. These smallest units are called "Satoshi", in reference to the inventor.

4 Should I buy Bitcoin?

"It is riskier to have no Bitcoin at all than to own at least a small amount". Unfortunately, the author of this quote is not known. However, this sentence, which is often shared in the Bitcoin community, contains a lot of truth. Speaking of "part": a big misconception that is always prevalent among beginners is the fact that they think you can only buy a whole Bitcoin and that this is already far too expensive. In fact, it is also possible to buy Bitcoin in fractions (these are called "Satoshi" in memory of the inventor). So you don't need to worry about this and can start with a small investment.

From an investment perspective, Bitcoin as an asset class has an unprecedented risk/reward ratio. While a total loss of -100% is very unlikely, but theoretically possible, on the other hand you have the chance of several 100% profit - even today, although the price already seems relatively high at first glance. In principle, there is no upper limit to the price, which is now prompting many major banks and institutional investors to make price forecasts in the six or even seven-digit range.

So if you invest a small portion (e.g. 5 - 10%) of your assets in Bitcoin, you could certainly get over a total loss with this small amount. However, if the price rises, you would benefit greatly from having already invested.

As the Bitcoin market or cryptocurrency market is still relatively small, it is still characterized by strong fluctuations. Price gains but also price losses in the double-digit percentage range within one day are not uncommon. You should always be able to "ride out" these fluctuations and neither panic nor fall into exuberant euphoria.

A good strategy for buying Bitcoin and entering the market is to first invest a small fraction of the planned capital and then buy more at fixed times. In this way, you balance out the price fluctuations and can start your investment soberly and rationally. Take a look at our article "What does DCA mean".

However, we would like to emphasize that this is not investment advice and you must decide for yourself whether the opportunity seems higher than the risk!

5 Where and how can I buy Bitcoin?

In order to buy Bitcoin, you must choose a provider and verify yourself if necessary. This verification is usually done by identifying yourself with your identity card or passport and serves to prevent money laundering and criminal transactions. Some providers are obliged to have their users go through these verification steps.

There are now many providers where you can buy and trade Bitcoin. We recommend our provider comparisonso that you can find the right service for you.

If you would like to start storing your Bitcoin yourself with a hardware wallet, we can recommend the Coinfinity stacking service. Here you can make a transfer to the service provider after the registration process and receive Bitcoin directly to your own wallet.

Another recommended stacking service is 21bitcoin. Here you can have your Bitcoin stored by the provider until you feel ready to become your own bank.

If you prefer to trade on an exchange, you should take a look at the Bison app from the Stuttgart Stock Exchange. Bison impresses with its intuitive user interface and the advantage of being able to transfer Bitcoin to your own wallet free of charge.

To be guided step-by-step through the buying process, take a look at our"Buy Bitcoin" guideguide.

6 What other cryptocurrencies are there?

Inshort: too many!

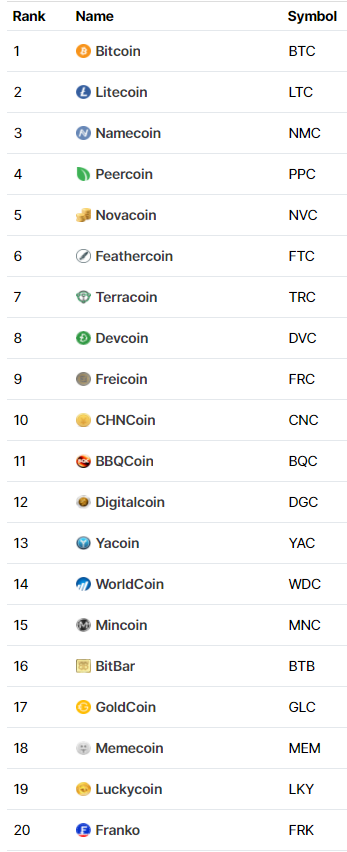

There are now thousands of so-called alternative cryptocurrencies, or "altcoins" for short. Almost all of them were not created to solve a problem or to be particularly useful due to their unique properties, but solely to sell them to gullible new investors as "the next big thing". In this way, many issuers of these altcoins were able to enrich themselves with the money of naive investors.

Almost every year, a new pig is driven through the village and promises are made by those responsible for the project that can never be kept.

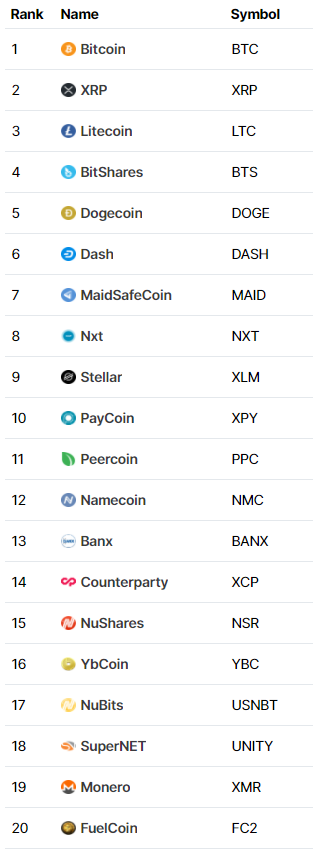

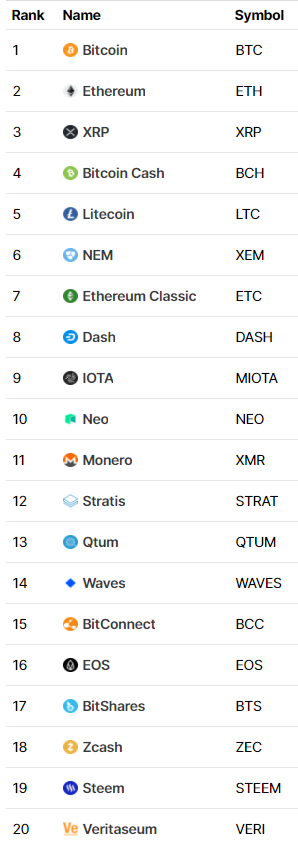

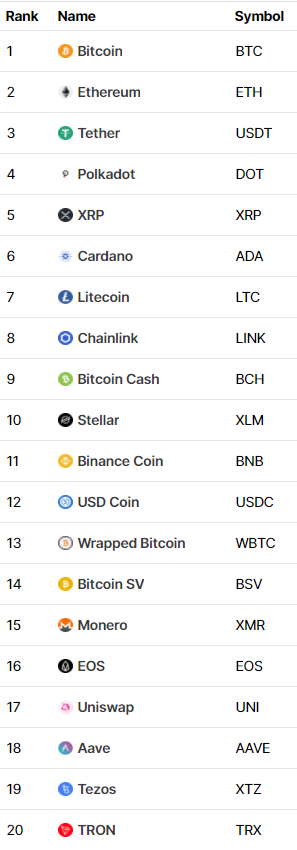

Portals such as CoinMarketcap or Coingecko list the various cryptocurrencies in descending order of market capitalization. Looking at the past, it is easy to see that the coins sold as "the future" or "the Bitcoin killer" change almost every year. Here is an overview of the top 20 coins of recent years (*click to enlarge):

Of course, there are also a few projects that were not created solely to defraud investors, that want to do certain things better than Bitcoin and that have now become widely established (caution: this means that other aspects are always neglected - usually security). Nevertheless, there are only a few exceptions in a large jungle of useless or fraudulent cryptocurrencies.

7 Should I also buy other cryptocurrencies?

In principle, we do not recommend buying or selling of any kind. However, we would advise beginners in particular to focus on Bitcoin first in order to gain an initial overview of the market and its dynamics.

Especially for beginners who are unable to assess the technological and economic fundamentals of the various cryptocurrencies, it is extremely difficult to distinguish between potentially sensible investments and groundless castles in the air.

8 How do I store Bitcoin safely?

The issue of secure storage is one of the most important when dealing with Bitcoin and cryptocurrencies.

To store your Bitcoin and cryptocurrencies securely and independently, you need a basic understanding of what cryptography is, what public and private keys are and how wallets work.

This may all sound incredibly complicated at first glance, but it's actually not. For a first introduction, take a look at our beginner articles to get started.

Depending on which provider you buy your first Bitcoin from, the type of custody differs. Some providers store your coins for you and you simply log in to the platform with your username and password. With other providers, such as Relai, you receive 12 or 24 words that serve as a backup for your Bitcoin. These words are VERY IMPORTANT and should be kept safe. They must also not fall into the hands of strangers. The advantage of storing them with 12 or 24 words is that the provider has no access to your assets and you can still get your coins, even if the provider suddenly goes bankrupt or simply disappears from the scene.

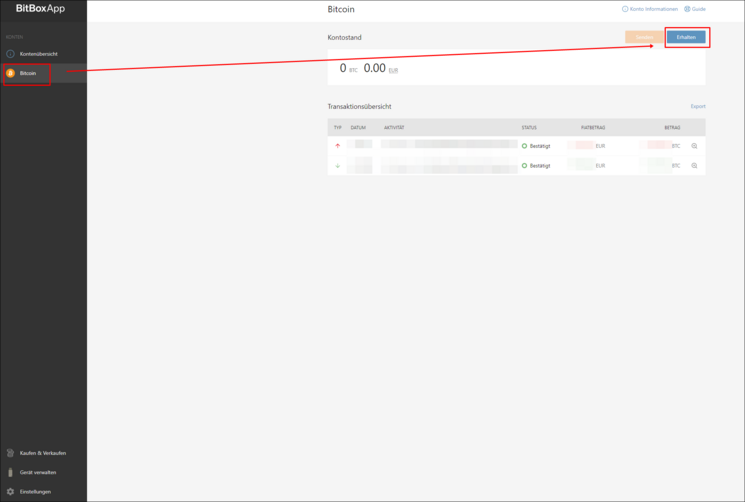

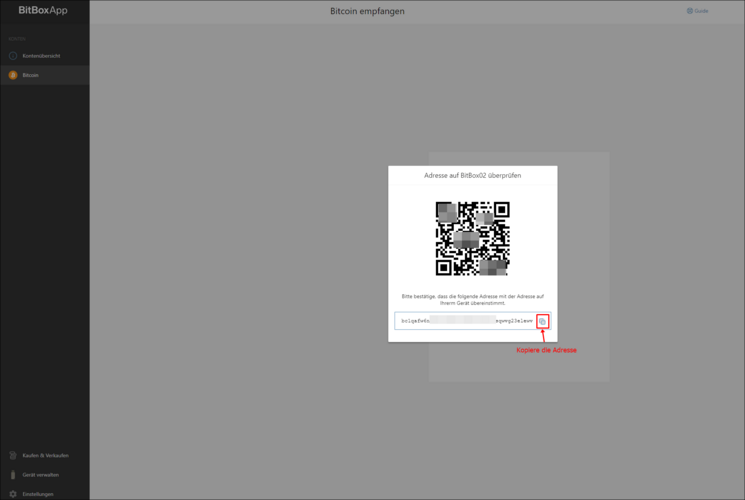

As soon as you have familiarized yourself with the whole topic and understand how wallets work and the differences between them, you should set yourself the medium-term goal of securing your coins with the help of a hardware wallet . Although these cost between €50 and €150, they are considered the most secure and yet user-friendly way to store cryptocurrencies.

We recommend the deviceBitBox02from the Swiss company "Shift Crypto", as it has special security features and is still very easy to use. From a higher investment amount, you should definitely consider purchasing a hardware wallet.

9. do I have to pay tax on Bitcoin?

Under certain circumstances. Profits from trading Bitcoin and other cryptocurrencies must be taxed in Germany if the coins have not been held for more than one year. To avoid falling into a tax trap, you should record your purchases (and sales, if applicable) right from the start. It is important to always be in a position to provide information to the tax office on request.

There are great free tools such as CoinTracking to make your work easier. Here you can register for free and import your transactions, track your profits and even generate a tax report at the end of the year. The tool really offers many functions and is very easy to use.

DISCLAIMER: We are not tax advisors and are not permitted to give advice or make specific statements on this subject.

10. what else should I know?

Last but not least, we would like to give you some best practices that you should take to heart.

- DYOR - Do Your Own Research. Don't rely on recommendations from others. No matter whether you receive information from acquaintances, the mass media or influencers. Always try to verify them and do your own research. Nobody knows when prices will rise or fall or what the "next big thing" will be!

- Don't fall for the glass ball predictions of so-called "chart analysts" and don't let them tempt you to act.

- One of the community's credos is "Be your own bank". However, this also means that you are responsible for yourself. So always proceed with caution.

- Always be skeptical!

- Think about whether it makes sense to invest regularly and in small amounts rather than all at once. This way you benefit from the cost-cutting effect (DCA).

- Don't let your emotions get the better of you and try to act rationally.

- Focus on understanding the technology, economics and philosophy of Bitcoin first.

- Take good care of your backups (12 or 24 words)! Store them protected from fire and water! Also, you should never save them digitally (e.g. as a photo)!

- Take measures to give your relatives access to your Bitcoin in the event of an accident. A good book that can help you with this is "Storing and Inheriting Bitcoins" by Marc Steiner.