How Bitcoin can prevent wars

Part 4: The finale

In the first, second and third parts of this series of articles, we have seen a number of examples of how states have repeatedly expanded the money supply to wage war. In the fourth and final part, we will take a look at how the currently prevailing fiat money system, like many fiat money issues before it, can also be traced back to war.

We will then look at the extent to which Bitcoin can prevent deadly wars, apart from the fact that, as the world's money, it would significantly restrict the financial scope of action of states. This includes the potential of the Bitcoin network to serve as a kind of proxy war and the theory that cooperation and free markets can make the world a more peaceful place.

War financing through money printing despite the gold standard

After the Second World War, the Bretton Woods system (1944 - 1973) reintroduced a kind of gold standard. The USA undertook to exchange the US dollar at a fixed exchange rate of 35 US dollars per troy ounce of gold. However, the US government's obligation to exchange gold only applied to foreign central banks and not to US citizens. The latter were even prohibited from privately owning gold worth more than 100 US dollars.

Although peace returned to the West during the gold standard, the USA repeatedly became embroiled in armed conflicts with emerging countries. Despite the gold standard, the USA also resorted to expanding the money supply at this time in order to cover the costs of war.

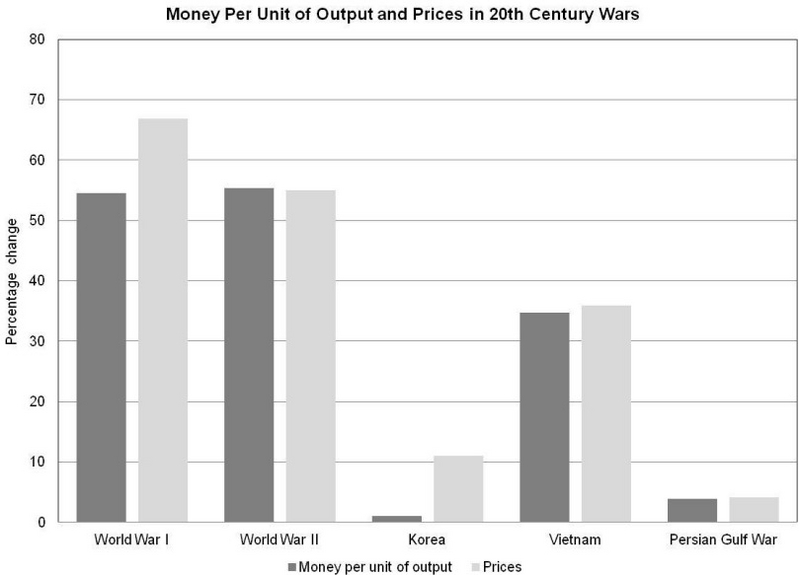

After the Second World War, the United States fought smaller colonial wars. In most cases, it was able to avoid financing these wars through the printing press. However, in both the Korean War and the Vietnam War, the administration exerted strong pressure on the Federal Reserve to expand the money supply and support government bond prices.

Rockoff: "War and Inflation in the United States from the Revolution to the first Iraq War"

Korean War (1950 - 1953)

During the Korean War, then U.S. President Harry S. Truman met with the Federal Reserve and asked that the central bank once again help finance the war.

At that conference, I asked [the Fed] to fully support the Treasury Department in its financing program, as they had done during World War II. [...] At that meeting I was assured that the Federal Reserve Board would support the Treasury Department's plans for financing operations in Korea.

Harry S. Truman

The Fed, however, would not bend completely and supported the US Treasury far less than it had during the Second World War. Ultimately, however, it still bought US government bonds and thus ensured that the interest rates on these remained as low as possible, which in turn bolstered public confidence in the US government.

Vietnam War (1955 - 1975)

The Vietnam War was much more cost-intensive than the Korean War. The USA expected the war to cost them 10 billion US dollars - in the end it was more than 150 billion US dollars. During the war, the US national debt doubled and both the money supply and the price level of goods rose significantly.

In addition to the war, the Great Society program (1963 - 1969), under which the government pumped money into the economy to reduce unemployment, was a decisive factor in the high level of government spending and inflation.

The above-average inflation, particularly during the last years of the war, should have led to greater increases in the US key interest rate, but the Federal Reserve maintained its expansionary monetary policy. At the beginning of the 1970s, the Fed even drastically lowered the US key interest rate.

As after the Korean War agreement, the Federal Reserve did not pursue a highly restrictive monetary policy, even though it had successfully asserted its independence. Open market operations [i.e. purchases of securities such as US government bonds by the Federal Reserve] continued to be expansionary, and the amount of central bank money and the money supply continued to increase.

Rockoff: "War and Inflation in the United States from the Revolution to the first Iraq War"

In 1965, foreign countries, led by France, began to exchange their US dollars for gold. The USA was still able to counteract this at times by raising interest rates, but high interest rates would have made debt-driven war financing more difficult in the longer term. The USA had little choice but to ask countries such as Germany not to exchange their US dollar reserves for gold. The German Bundesbank promised the US that it would hold on to the US dollar - an agreement that the then President of the Bundesbank regretted as early as 1970.

We should have aggressively exchanged dollars for gold until [the Americans] were driven to despair.

Karl Blessing (1970)

Towards the end of the Bretton Woods system, the US was simply printing too many US dollars to cope with escalating government spending. In addition to the Vietnam War and the Great Society program, there was also the space race against the Soviet Union as part of the Cold War (1947 - 1989). The moon landing in 1969 cost the USA almost 30 billion US dollars, which was a lot of money, especially by the standards of the time.

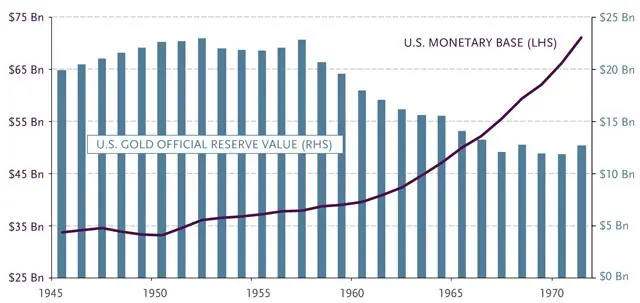

At the beginning of the Bretton Woods system, 75 percent of the US monetary base (money in central bank accounts + cash) was backed by gold - in 1971 it was only 18 percent. As there were more and more US dollars in relation to the US gold reserves, the US dollar was heavily overvalued at the official exchange rate. On the free market at the time, significantly more than the 35 US dollars per troy ounce of gold had to be paid. In addition, the participating countries repeatedly devalued their own currencies, which were pegged to the US dollar at a fixed exchange rate, in order to maintain the fixed exchange rate system.

In the 1960s, a dollar surplus caused by foreign aid, military spending and foreign investment threatened this system, as the United States did not have enough gold to cover the volume of dollars in circulation worldwide at the rate of 35 dollars per ounce; as a result, the dollar was overvalued.

Office of the Historian

The Nixon shock

Foreign countries eventually became increasingly suspicious and their concerns were not unfounded: In 1971, foreign central banks had US dollar reserves of over 50 billion US dollars, compared to US gold reserves of just around 12 billion US dollars. Shortly after Switzerland exchanged USD 50 million and France USD 169 million for gold in the summer of 1971, the situation became more than precarious for the USA. France even sent a warship to collect the gold. A few days later, US President Richard Nixon revoked the convertibility of the US dollar into gold. He blamed speculators for this extremely drastic measure. Nixon spoke of a temporary suspension of convertibility, but to this day the US dollar cannot be exchanged for gold. Instead of the 35 US dollars, around 2,000 US dollars per troy ounce of gold must be paid on the market today. The saying "nothing is as permanent as temporary government intervention" is no coincidence.

In recent weeks, speculators have unleashed a full-scale war against the US dollar. [...] I have instructed Treasury Secretary Connally to suspend temporarily the convertibility of the dollar into gold or other reserve assets [...].

Richard Nixon (1971)

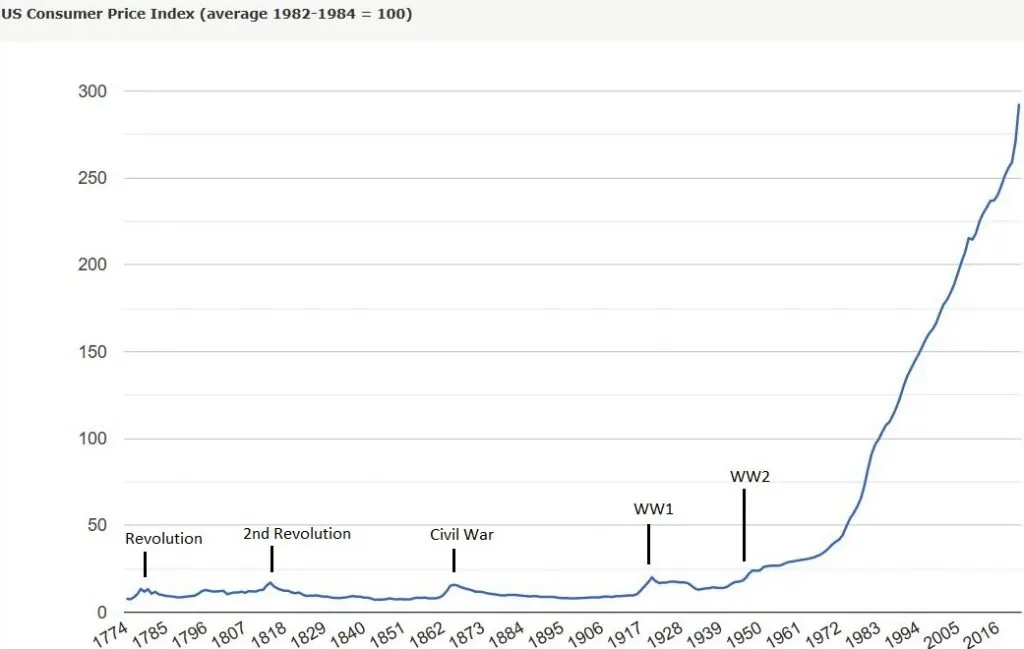

The era of fiat money

Before the world wars, we experienced in the USA that after the expansion of the money supply to wage war, goods prices were always able to stabilize at a similar level. Until the First World War, the US consumer goods price index always stabilized at a value of around 8 in peacetime. As more and more Western economies listened to the recommendations of John Maynard Keynes during the First World War, the peacetime value receded into the distance. After the Second World War, the Keynesian school of thought continued to spread. Since the gold standard, which Keynes also called a "barbaric relic" was abolished by Nixon, US consumer goods prices have increased roughly tenfold.

Before the Second World War, monetary policy in peacetime was mainly geared towards maintaining the gold standard. [...] As Keynesian economics became the dominant paradigm, economists and policymakers came to believe that the Federal Reserve could reduce unemployment through expansionary monetary policy with acceptable effects on inflation.

It is no exaggeration to say that after World War II, what once characterized unique wartime finances - high government spending financed in part by borrowing from the public and in part by money creation - became the norm in peacetime.

Rockoff: "War and Inflation in the United States from the Revolution to the first Iraq War"

The economist Saifedean Ammous even sees Keynesianism as one of the main reasons for the wars of the 20th century. Ammous argues that wars were waged based on the Keynesian misconception that high government spending alone - even for wars - was good for the economy:

The war machine that state-directed economies built was far more advanced than any the world had ever seen, thanks to the popularity of the most dangerous and absurd of all Keynesian fallacies, namely the idea that state military spending would promote economic recovery. In the naive economics of Keynesians, every expenditure is an expenditure, and so it doesn't matter whether that expenditure comes from individuals feeding their families or governments murdering foreigners: It all counts toward aggregate demand, and it all reduces unemployment!

Ammous: "The Bitcoin Standard"

The bottom line is that the decision whether or not to start a war is influenced by numerous components. Through the eyes of Saifedean Ammous, the reason why the period after the 1970s to the present day has been relatively peaceful could be attributed to the fact that Keynesianism lost popularity due to the strong waves of inflation in the 1970s. Even if there has been no end to inflation since then, one could argue that at least the assumption that government spending is a good thing per se has been rejected in mainstream economics.

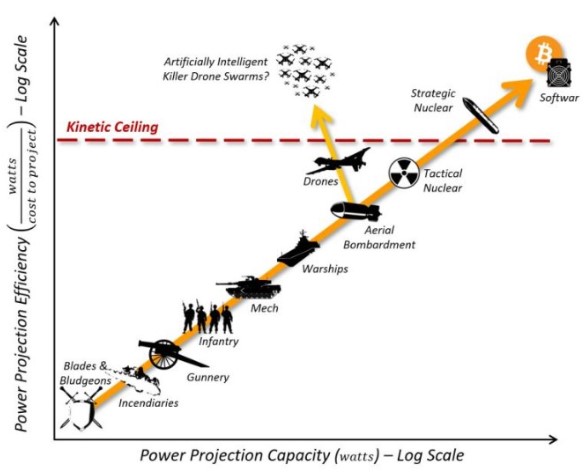

More decisive for the relatively peaceful period since the 1970s, however, is probably the fact that war technologies have become too efficient - warlike conflicts between nuclear powers can no longer produce any real winners. This is also known as the kinetic power paradox.

Softwar

This is where bitcoiner and US Space Force employee Jason P. Lowery comes in. In his MIT master's thesis Softwar Lowery explains that the physical exercise of power is essential in order to clarify ownership relationships fairly. The alternative is abstract hierarchies of power that are never protected from exploitation for the benefit of a few. Lowery points out that the dysfunctions of these are a driver of war.

Once we understand how and why imaginary power and real power produce different behavior, we can understand why abstract power hierarchies have so many dysfunctions that lead to war.

Lowery: "Softwar"

For Lowery, however, wars are ultimately a good thing, as they prevent an abstract hierarchy of power from spreading across the entire world.

Whatever it is called - war or revolution - physical power always proves to be an effective means of preventing the centralization of control and the expansion of abstract power.

Lowery: "Softwar"

Accordingly, Lowery finds it problematic that traditional wars between great powers are no longer a real option. If one follows this line of argument, the solution lies in a physical projection of power, or in wars that do not claim human lives. Deer already have a solution to this: in the course of evolution, they have developed antlers with which the males fight among themselves in order to establish a hierarchy without injuring each other.

Proxy wars through technology

Lowery concludes that the Bitcoin network, which has a physical anchor in the real world through Proof of Work and is therefore egalitarian and fair, can be a kind of deer antler technology for humanity.

What makes Bitcoin so remarkable is that it seems to have created a non-lethal equivalent to warfare that achieves the same complex, evolving benefits of traditional warfare by utilizing the exact same social protocol of physical power competition [...] but it removes the mass in these power competitions and exchanges it with energy, eliminating the ability for human injury and intraspecies fratricide.

Lowery: "Softwar"

The power in this proxy war should then be exercised by those who use the reusable proof of work, i.e. Bitcoin.

In the future, when this new architecture is built, the only way you can attack people is if you have a lot of Bitcoin. [...] If you build the barriers so that the only way you can be attacked is if something is collateralized with Bitcoin, then guess what's just been done: You put a physical restriction on that attack. [...] So what does that mean for the future of warfare [...]? Bitpower [i.e. bitcoin] is a big deal. You need a lot of it [...] and you need to maintain decentralized control of it by creating and supporting a robust hashing infrastructure.

Lowery in an interview

Even the proponent of this thesis is certain, however, that we will not be able to completely avoid the traditional physical exercise of power. According to Lowery, kinetic weapons will still play a role, even if they only serve to make an attack in the physical world as unprofitable as possible.

Of course, there would still be a hard war, but perhaps only to settle minor tactical disputes or to preserve the kinetic power paradox [...].

Lowery: "Softwar"

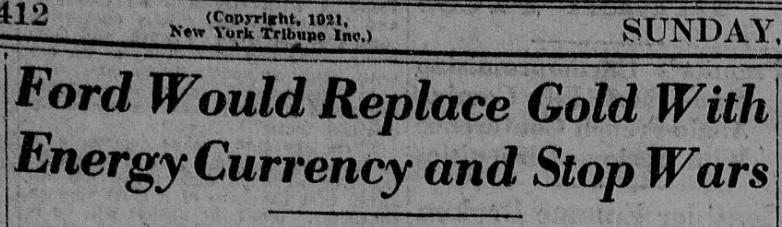

As unusual as Lowery's theory may sound, preventing deadly wars by harnessing electricity is actually not a new approach. Back in 1900 , inventor Nikola Tesla hypothesized that an electricity competition between machines had the potential to resolve human disputes.

Also more than 100 years ago, Henry Ford, the founder of Ford Motors, claimed that an electronic currency based on units of energy, which could not be controlled by banks like gold, would prevent wars.

The essential evil of gold in its relationship to war is the fact that it can be controlled. If you break the control, the war stops.

Henry Ford (1921)

Bitcoin, unlike gold in its basic form, is suitable for transactions in a globalized and digital world. This means that Bitcoin can be used as money without having to resort to banks or middlemen, who can use their power and sometimes confiscate the money. The fact that gold is physical also has some disadvantages when it comes to looting, which has often played a decisive role in wars.

Looted gold

One aspect of war financing that should not be neglected is what is also known as looted gold. For example, during the Second World War, the Nazis were able to raise additional funds by appropriating the gold reserves of the central banks of conquered countries. The slogan "war feeds war" describes something similar. This originates from the Thirty Years' War, in which funds became so scarce at some point that the mercenaries obtained their wages by plundering the civilian population.

Even the hapless "Winter King" Frederick V was unable to finance the troops who fought for his cause in Bohemia in 1620 in the long term - which led to them plundering villages and pillaging the civilian population.

bpb: "Thirty Years' War"

Bitcoin is a money that people can store by memorizing just twelve words. In this case, it would therefore only be possible to steal the Bitcoin if the person to be robbed is persuaded, for example by the threat of violence, to hand over the private keys hand over the private keys. One way to prepare for such a situation would be to set up a Bitcoin wallet with only a small amount of Bitcoin in it and simply claim that this is all there is.

The revolutionary custodial methods that Bitcoin enables make looting, which can keep a war going or even be a prime motivator for it in the first place, far less lucrative than monetizing easier-to-steal precious metals.

Michael Saylor, the founder of MicroStrategy, a publicly traded company that strategically buys Bitcoin, goes so far as to claim that gold is an encouragement to war.

In the one extreme case where all the property is in the land, there is an invitation to war because the land right next to you can invade your borders and take all the property, especially if the property is something that can't be destroyed like gold. [...] So gold is an encouragement to violence from the outside - an encouragement to war.

At the other extreme, all property is digital. So the enemy nation-state crosses the border and kills everyone, and there is no more property. There is nothing to confiscate because the property is gone because it is in cyberspace. [...] If all property is essentially bitcoin and digital, then there's no point in invading the land because you get nothing. [...] All bitcoin will have left the country. They will be shipped into cyberspace, put into a timelock multisig or shipped to another country. Bitcoin can move faster than the army. So it's not really productive to fight a war to get [Bitcoin].

Michael Saylor in an interview

Bitcoin gives us a new understanding of what ownership is. Private property is essential for a prosperous economy. The abolition of private property - communism - has led not only to poverty but also to the deaths of some 60 million people.

Free markets against war

Advocates of private property often take issue with states. The reasoning is that states, unlike free markets, are based on coercion and not on voluntariness. Moreover, states tend to expand further and further over time. The example of the USA, which was founded as a kind of minimal state without income tax, illustrates this regularity particularly well.

The state (as we know it today) is aggressive both internally and externally; it also has an incentive to wage wars with other states in order to assert its interests by force. State and war go hand in hand, so to speak.

Polleit: "State and war"

Ultimately, it is usually states that wage wars. Accordingly, representatives of the Austrian School emphasize that less state leads to more peace.

So, as Ludwig von Mises said, if you want to prevent war effectively, you must try to limit the state and, with it, politics and politicians to the greatest extent possible; and you must also advocate the free market, because it is the guarantor of peace and prosperity for people on the planet, and not the state (as we know it today).

Polleit: "State and war"

The economist Thorsten Polleit goes on to explain that the free market promotes peace because people recognize each other as useful due to the division of labour and are therefore interested in ensuring that the people they trade with are doing well. Cooperation is a dominant survival strategy. The increasing globalization of recent decades, facilitated by the communication possibilities opened up by the internet, is also often cited as one of the main reasons for the relatively peaceful past decades.

Bitcoin is a global money that already enables us to trade with people in distant countries without middlemen. For example, we can pay people from Nigeria directly to program a website for us. Furthermore, everyone is equal before the Bitcoin network and strengthens it with their participation.

Bitcoin against aggressive states

Bitcoin, as a limited and non-manipulable money, can enormously restrict the financing options of states if mankind decides to use Bitcoin as money. Wars are so expensive that, almost without exception, the money supply has had to be expanded by the state. If this option were removed, wars would presumably at least be much shorter and less deadly, or perhaps not even be started in the first place.

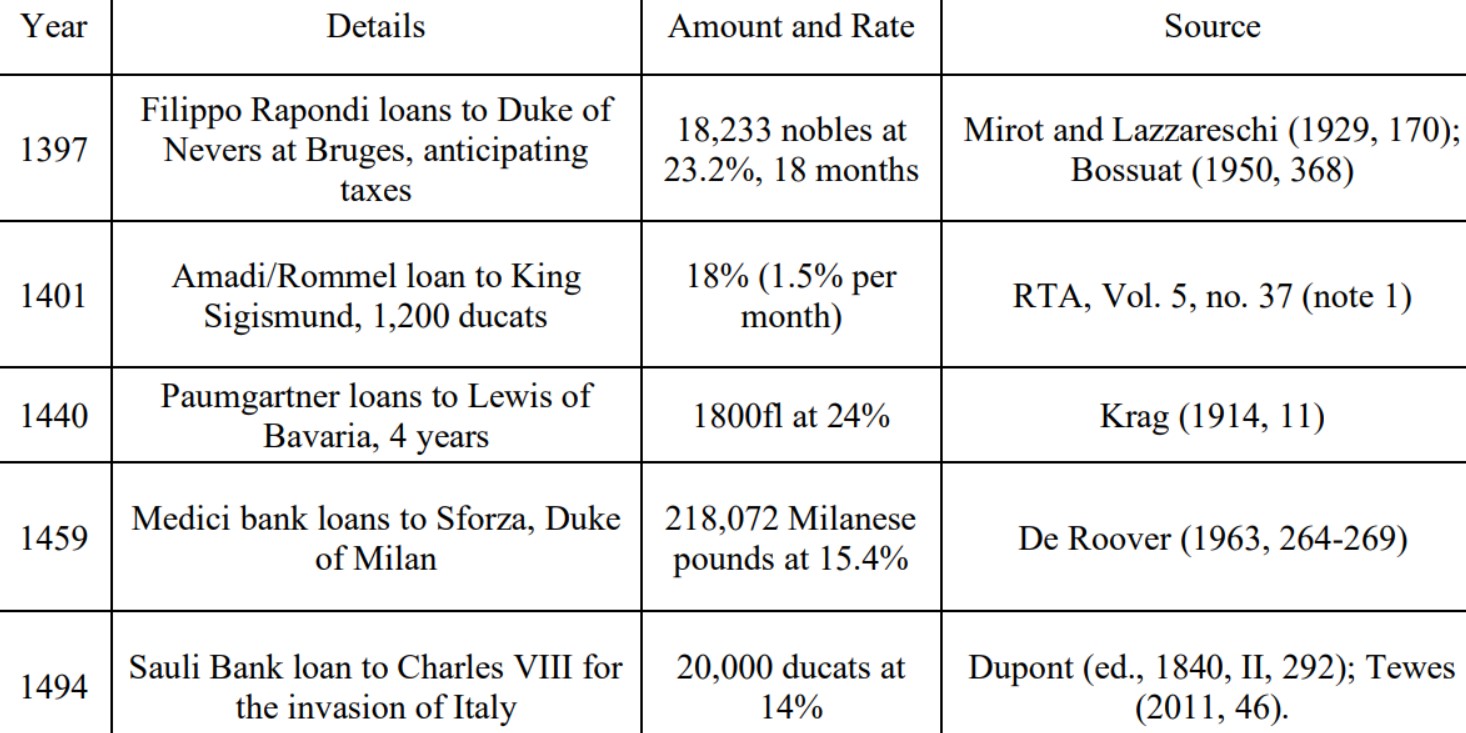

One example that supports this thesis is the planned invasion of Italy by the French King Charles VIII. Charles had to borrow 20,000 ducats, i.e. gold coins, at an interest rate of 14 percent. The fact that he borrowed in hard money, which he could not manipulate himself, prevented further attacks.

One problem that arises at this point is that a state that gives up its own currency for a free currency may find itself outgunned in the event of war by countries that can raise far more funds to wage war in the short term through the inflation tax.

What makes Bitcoin so special as a potential solution to this problem is that it is a global grassroots movement that could ultimately financially penalize anyone who will not join it. Thus, the Bitcoin revolution has the potential to suck up more and more monetary energy so that all fiat currencies, and with them the power to expand them, tends towards zero. For the first time, Bitcoin offers the possibility of limiting the strength and thus aggressiveness of all states equally - and peacefully.

In addition, wars of aggression are generally more expensive than defense. In the military sector, it is generally assumed that the attacker must be outnumbered by a factor of around three in order to have a good chance of success.

A fairer world with Bitcoin

There is a case to be made that in a Bitcoin world, certain states will no longer be as superior as they currently are.

The US, for example, has benefited considerably from having control over the most widely used currency in the world. The term "petrodollar" comes from the fact that after the Second World War, oil was mainly settled in US dollars, i.e. in a currency that the USA can print. Furthermore, institutions such as the World Bank and the International Monetary Fund granted US dollar loans to emerging countries. The loans boosted global demand for US dollars, which in turn gave the US more scope to expand the money supply for its own benefit. In particular, however, these loans made the emerging countries dependent, as they had to focus their economies on exporting cheap products in order to be able to obtain US dollars at all.

With Bitcoin as the world's money, such exploitation could no longer take place and the urge to expand one's own currency area would disappear. In addition, it is the economically weaker countries, such as El Salvador, that are the first to recognize the need to adopt Bitcoin. If Bitcoin becomes the world's money, it will probably be the poorer countries that will benefit the most because they could buy a lot of Bitcoin at a favorable exchange rate. Furthermore, the economic balance of power could be further decentralized because energy that can be monetized through Bitcoin mining can be used worldwide.

Conclusion

The title of this series of articles was chosen deliberately - Bitcoin can prevent deadly wars. First and foremost by making one of the main ways of financing war - the centralized expansion of the money supply - impossible. Most of the time was devoted to this argument in order to impressively demonstrate the close connection between wars and uncovered state paper money.

If Bitcoin becomes the world's money, it is also highly unlikely that states will be able to reintroduce a fiat money system to finance war. This has happened several times with gold as money, as gold is automatically centralized in the hands of corruptible entities. Due to its physical nature, gold is not suitable for trade in a globalized and especially in a digitalized world. Moreover, gold can be banned and confiscated much more easily by the warmongers in order to weaken competition with fiat money or to obtain additional means for waging war. Bitcoin, as a non-corruptible and non-confiscable money that can be used to carry out digital cross-border transactions in its basic form, solves these problems.

Hard money alone is therefore not the solution to wars. What distinguishes Bitcoin from gold, especially as far as wars are concerned, cannot be ignored. Henry Ford recognized the disadvantages of precious metals such as gold in this respect more than 100 years ago. Michael Saylor even came to the conclusion that gold, because it is an indestructible physical object of value, can be an encouragement for wars - at least if people attribute a lot of value to this precious metal.

It remains to be seen whether humanity can manage to replace deadly wars with proxy wars using Bitcoin, or whether it is even possible at all. As beautiful as the idea is, Lowery's explanations of what this could actually look like still convince very few people.

Bitcoin certainly has the potential to lead people peacefully into a freer and more cooperative world. The very fact that humanity uses the same money could contribute significantly to a stronger sense of community. Not least because every participant in the Bitcoin network strengthens it, which in turn benefits the other participants. Furthermore, Bitcoin is also an opportunity to limit - if not completely get rid of - the size and aggressiveness of states, which ultimately start wars in the first place.

The slogan from the Bitcoin community "make war unaffordable " sums it up pretty well.