Bitcoin ETF hype over?

BlackRock's Bitcoin ETF without inflows for the first time

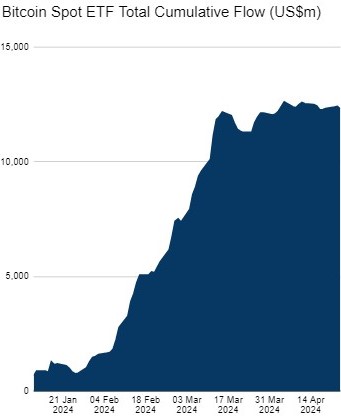

The Bitcoin spot ETFs approved in the US in January were probably the biggest price driver for Bitcoin in recent weeks and months. On the one hand, the Bitcoin price rose significantly in anticipation and then ignited the rocket when the investment products together recorded net inflows of over USD 10 billion from the beginning of February to mid-March.

However, since mid-March, when Bitcoin also set a new all-time high of around USD 73,800, inflows have stagnated and the Bitcoin price has corrected. The asset is currently only trading at around USD 64,000, around 13% below its all-time high.

BlackRock's ETF weakens

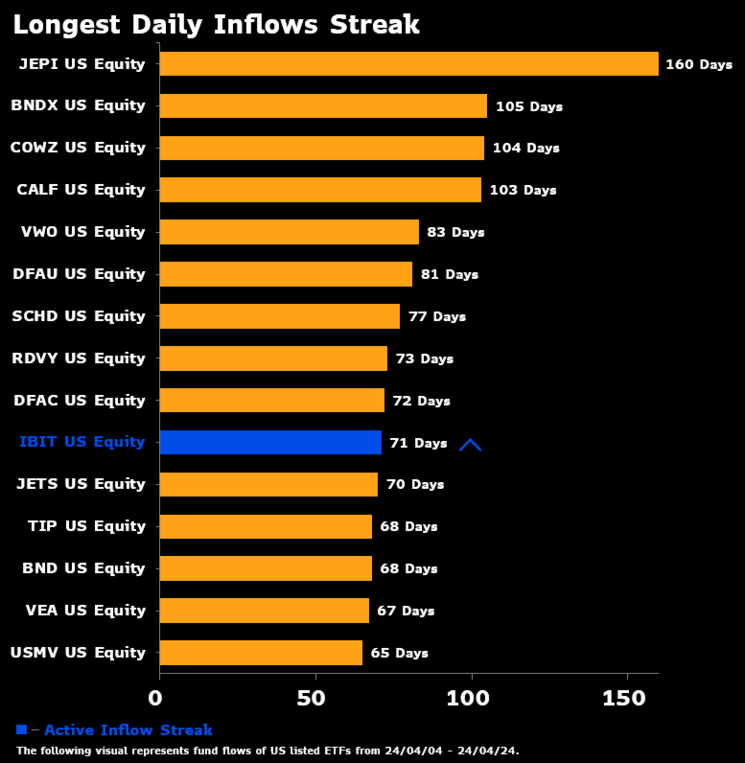

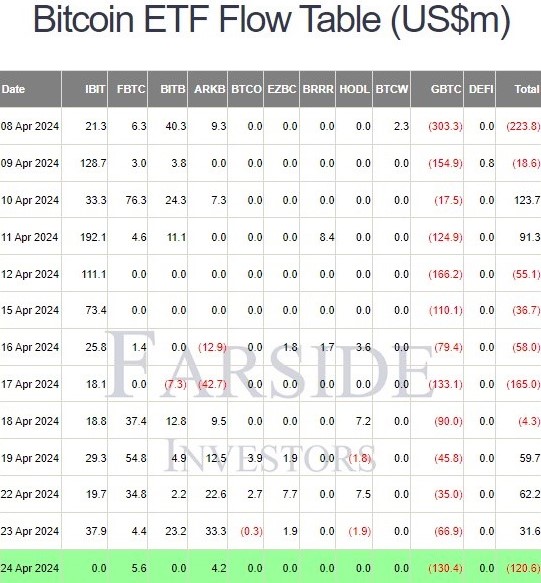

The slowdown in demand for the new investment products has now also led to BlackRock's ETF ($IBIT) recording no inflows on a trading day for the first time. Until yesterday, $IBIT still had the longest active inflow streak of 71 days, putting it in the top 10 of the most consecutive inflow days ever for an ETF. But on yesterday's trading day, the "fastest growing ETF in ETF history" according to BlackRock CEO Larry Fink, soaked up no more new capital and posted a zero for the first time.

IT'S OVER: $IBIT took in $0 yesterday, ending its 71-day daily inflow streak. While this is just shy of the all-time record, it is a historic figure, completely surpassing the previous record for a new inflow. For comparison, $GLD had a fantastic start and its "out of the gate" inflow streak was three days.

Eric Balchunas, ETF expert at Bloomberg

Fidelity's Bitcoin ETF ($FBTC), which is the second best performing newly launched Bitcoin spot ETF behind BlackRock's, ended its inflow streak after 63 trading days. Although the exchange-traded fund of the world's third-largest asset manager behind BlackRock and Vanguard has since recorded further trading days with a zero, no funds have yet flowed out of the ETF.

Total inflows are still stagnating at a high level, which means that the investment products can still be considered a great success. The gold ETF ($GLD), for example, recorded significant outflows a few weeks after admission, only to then collect capital almost exclusively for years. A short breather is therefore anything but a reason to worry.

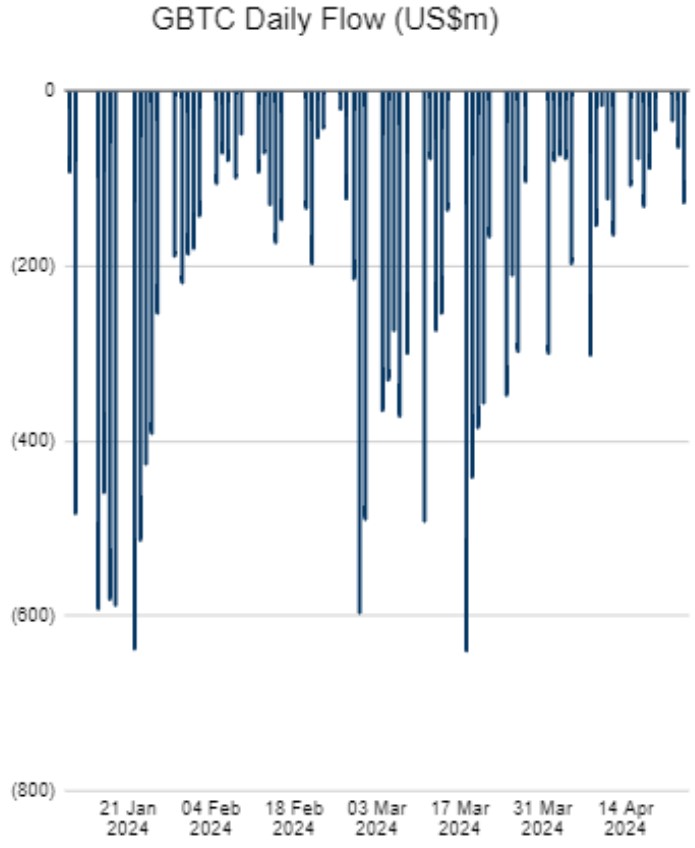

Still outflows from the Grayscale ETF

While there is less demand for the completely newly launched Bitcoin ETF, Bitcoin continues to flow out of Grayscale's investment product ($GBTC), which was converted from a closed-end trust into a spot ETF. Although somewhat less than in the first few weeks or in March, this trend does not appear to be abating for the time being.

The outflows in the context of the bankruptcy of the crypto lending company Genesis have been completed since the beginning of this month. However, more holders appear to want to part with the investment product launched back in 2015. It is unclear to what extent they are switching to cheaper alternatives.

However, the selling pressure could soon be alleviated somewhat as soon as Grayscale receives the green light from the US supervisory authority for the Bitcoin Mini ETF ($BTC). With a fee of 0.15 percent, the mini-ETF will only charge a tenth of the annual costs of $GBTC, making it the cheapest Bitcoin ETF ever. Holders of $GBTC should be able to exchange $GBTC for $BTC at a certain rate, without incurring taxes in the process, and thus pay lower fees overall.

BlackRock's $IBIT is well on its way to becoming the largest Bitcoin spot ETF despite declining demand. The investment product of the world's largest asset manager currently holds around 275,000 BTC, which is only around 25,000 less than $GBTC, which held just under 620,000 BTC at the time of conversion.

The risk of higher US inflation

Now that the conflict between Iran and Israel, which dragged Bitcoin down with it, has eased again for the time being, higher-than-expected US inflation appears to be having a dampening effect. High inflation could thwart the US Federal Reserve's plans to cut interest rates again soon and thus boost the financial markets.

At the beginning of the year, the market was still expecting several interest rate cuts this year. Now the market is only pricing in one or two, with the first rate cut in September. Although the financial market was initially unimpressed by the postponed monetary easing, it has now also gone into correction mode. Last Friday, the S&P 500 traded 6 percent and the Nasdaq 100 8 percent below last month's highs.

While market observers such as JPMorgan CEO Jamie Dimon are warning that the US Federal Reserve could raise interest rates from the current range of 5.25 - 5.50 percent to 8 percent and higher, contrary to expectations, there are increasing estimates that inflation of 4 percent could become the new normal. Yesterday, for example, Bloomberg ran the headline "How 4% could be the new inflation target". In the article, the author recognizes that central banks have apparently become more flexible or less strict when it comes to inflation rates. He references analyst Vincent Deluard from the US financial services group StoneX, who believes that an inflation target of 4% is appropriate in order to allow the state to continue spending money without triggering an inflationary spiral.

In view of the US national debt, which is constantly rising to new heights, interest rates that remain at a high level for longer or even increase would only cause the debt to escalate further. The US Federal Reserve, which is probably only independent on paper, currently finds itself in a dilemma. At 3.5%, US inflation is well above the 2% target, but the Federal Reserve is finding it difficult to counteract this with interest rate hikes, as this could stifle the economy in the important election year and further fuel the US debt spiral.

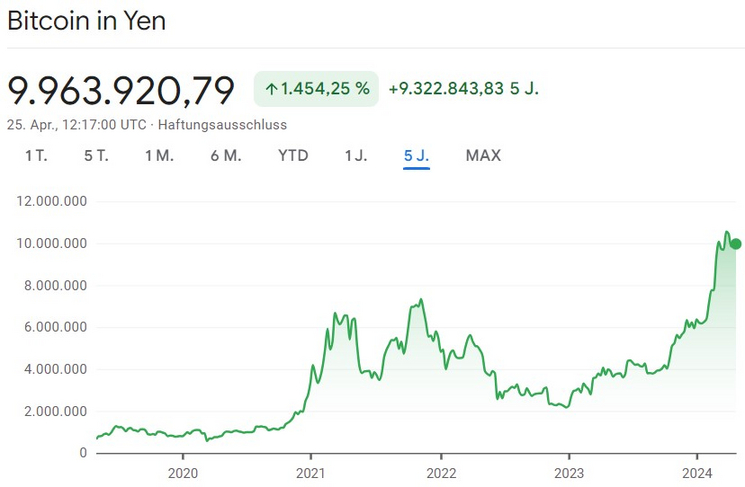

How the situation plays out remains to be seen. But the fact that the Federal Reserve is signaling that it intends to cut interest rates soon despite high inflation is likely to be interpreted as a sign that the US dollar and other fiat currencies will continue to lose purchasing power. And a look at countries such as Japan or Turkey shows how well Bitcoin can protect against the weakness of a currency.

Further prospects

While the ETF hype in the US is waning somewhat, a new one could soon emerge elsewhere. Next Tuesday, on April 30, the Bitcoin spot ETFs will be tradable in Hong Kong for the first time. Bloomberg analysts are forecasting inflows of one billion US dollars in the medium term and are therefore predicting a major success for the smaller capital market in the Chinese Special Administrative Region. Rebecca Sin from Bloomberg Intelligence is also confident that Bitcoin spot ETFs will soon be tradable in South Korea and Australia.

If it becomes possible for more and more investors to invest securely in Bitcoin via the structures they are familiar with, this could fuel the price further. The floodgates are now wide open in more and more jurisdictions so that institutional investors can comfortably build up positions in the asset, even if they may not discover Bitcoin for themselves until later.

In addition, the fourth Bitcoin halving took place on Saturday night. Since then, Bitcoin has had lower inflation than gold, as the total amount of BTC is now increasing at 0.85 percent per year, while gold is increasing by around 1.5 percent annually. This not only means that Bitcoin is now the harder asset or money than gold, but also that fewer new BTC are being added each day to meet both organic and potentially growing demand. However, it remains to be seen whether the halving effect will prove to be a catalyst for sharply rising prices, as it has in the past.