Grayscale Mini Bitcoin ETF

New Bitcoin ETF with the lowest fees to come

Grayscale is planning to list an additional Bitcoin spot ETF on the US stock exchange. The asset manager already submitted the application for this on March 12 of this year.

The news: The investment product is to have a management fee of just 0.15 percent, which would make the Grayscale Bitcoin Mini Trust ($BTC) the cheapest Bitcoin spot ETF. So far, this is $EZBC from Franklin Templeton with 0.19 percent - if you exclude the offers of no fees for the first few months or up to a certain investment volume of some other Bitcoin ETFs.

Grayscale would also like to shift more than 63,000 BTC from its already tradable ETF ($GBTC) into the Bitcoin mini-ETF. This is according to a recent filing by the company with the US Securities and Exchange Commission (SEC).

- 63,204.15294574 Bitcoin will be transferred from GBTC to the BTC Trust

- the fee to be paid for the BTC shares is 0.15%

From the filing

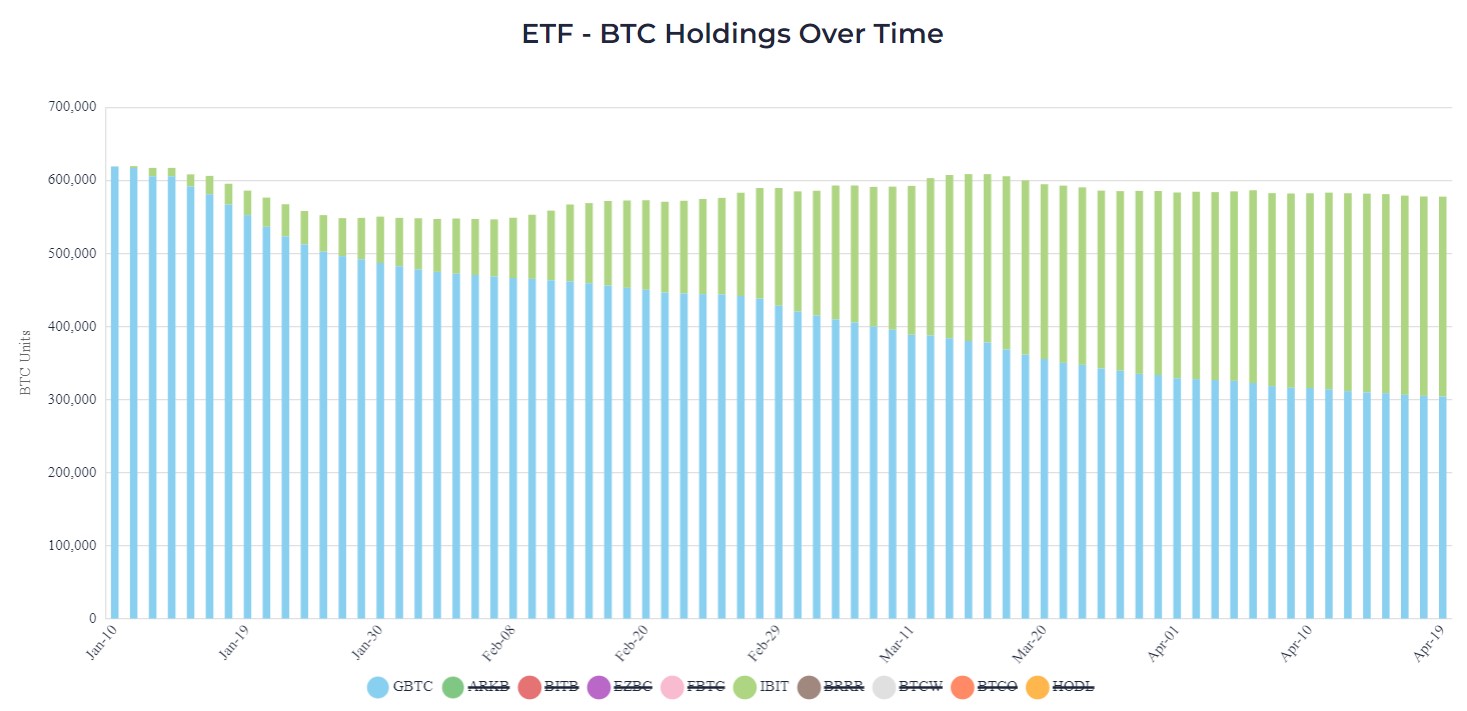

The problem with the largest Bitcoin spot ETF

When the SEC gave the green light for Bitcoin spot ETFs in the US on January 10 this year, Grayscale's closed-end trust was allowed to be converted into a spot ETF. At the time, there were still around 620,000 BTC in the investment product, which the asset manager from the crypto industry launched in 2015. Because investors were previously only allowed to sell their shares but not exchange them for Bitcoin due to the structure of the trust, the price of $GBTC temporarily decoupled significantly from the price of Bitcoin - in both directions.

Since $GBTC has been a Bitcoin spot ETF, funds have been flowing out of the investment product every trading day. There are currently only 304,000 BTC in the fund, i.e. less than half at the time of ETF approval. The main reason for this is the high management fee of 1.5 percent - BlackRock, for example, only charges an annual fee of 0.25 percent for its in-house Bitcoin ETF $IBIT, which has seen inflows every 69 trading days and is only a good 30,000 BTC away from replacing $GBTC as the largest Bitcoin spot ETF.

The Bitcoin Mini ETF

Grayscale would like to counteract these outflows with the new Bitcoin mini-ETF. According to the filing, the asset manager plans to use the 63,000 BTC to shift more than 20 percent of the investment volume from $GBTC to the Bitcoin mini-ETF. However, this amount, as well as the planned fee of 0.15 percent, is not binding and could still be changed by Grayscale.

The units of the Grayscale Bitcoin Mini Trust ($BTC) are to be distributed automatically to the holders of $GBTC. The advantage of this process is that no capital gains tax is incurred.

Investors who have already been holding $GBTC for years and have accordingly reaped phenomenal returns should therefore save fees through the planned investment product, without a reallocation becoming a major loss-making transaction due to taxes.

We believe this would be beneficial for existing GBTC shareholders as they would benefit from a lower blended fee (covering ownership of GBTC and BTC shares) while maintaining the same exposure to Bitcoin.

Grayscale

Launching a mini-ETF is a common practice for ETF issuers to provide their clients with a more attractive in-house alternative. For example, in addition to the largest gold ETF, SPDR Gold Shares ($GLD), there is also a successful mini-ETF, SPDR Gold Minishares ($GLDM).

Grayscale could have simply lowered the fees for $GBTC, but this would mean that the asset manager would be missing out on attractive income. There are currently around 20 billion US dollars in $GBTC, which, with the management fee of 1.5 percent, would mean almost 300 million US dollars in annual income - at the current Bitcoin price of around 65,000 US dollars and if no more funds were to leave the ETF.

Implications for the Bitcoin ETF market

The Grayscale Bitcoin Mini Trust is not yet authorized and the 0.15 percent management fee is only pro forma, i.e. not binding. It is quite conceivable that Grayscale will be able to cushion the outflows from $GBTC somewhat with $BTC, as the mix of the two ETFs would reduce the overall fees for existing $GBTC holders. However, it remains to be seen to what extent final shares of $GBTC will be replaced by $BTC.

It will be interesting to see how much new capital will flow into the investment product with the lowest fees. However, as the management fee of most ETFs is around 0.2 to 0.3 percent, it is unlikely that investors will shift towards $BTC due to an only slightly more attractive fee.

$BTC would be the twelfth Bitcoin spot ETF tradable in the US. With the 63,000 BTC on offer, the mini-ETF would directly become the fourth largest Bitcoin spot ETF, ahead of ARK Invest's ($ARKB). However, it remains to be seen how many BTC will ultimately be included in the anticipated approval.

The exchange-traded funds from the US are very popular and are a profitable business for their issuers despite the relatively low fees. Since their approval, Bitcoin spot ETFs have recorded cumulative inflows of over USD 12 billion. However, since mid-March, when Bitcoin reached its current all-time high of around USD 73,800, buying demand has slowed somewhat.