EU & USA: Massive restrictions against financial privacy!

The struggle between freedom & financial repression

In recent days, the European Union and the USA in particular have taken significant steps aimed at further restricting financial privacy. The developments affect both the area surrounding Bitcoin and other cryptocurrencies as well as that of traditional cash. For many observers, the current actions of the states are a demonstration of power that could have a clear agenda behind it.

EU: restrictions on cash and cryptocurrencies

Blocktrainer.de already reported yesterday that the European Union has decided to tighten its money laundering laws. By a large majority, EU parliamentarians voted in favor of a new law that prohibits anonymous cash payments in a business context over 3,000 euros and payments with cash over 10,000 euros in general. In addition, anonymous transactions with cryptocurrencies from externally managed wallets ("hosted wallets") are prohibited in any amount. The measures are aimed at combating money laundering and other illegal activities, but have also met with considerable criticism. Civil rights activist and MEP Dr. Patrick Breyer (PIRATEN) criticizes in particular the excessive surveillance and the resulting threat to financial privacy. His party colleague Anja Hirschel also criticized the procedure accordingly:

'Cash payments are being increasingly restricted and at the same time anonymous online payments are being banned. This leads to ever more detailed traceability of our consumption and private lives. How much I spend on what, when and where allows ever more precise conclusions to be drawn about me as a person. In connection with the national discussions about payment cards for different groups of people, this could be a building block towards a legal basis for subsequent profiling and control of even legal expenditure.

Quote from Anja Hirschel

USA: Arrests and warnings

In the US, there have also been a number of events in the authorities' fight against anonymity in the financial and, in particular, crypto sector, which underline the increasingly hard line taken by state officials.

Probably the most severe example of this is the arrest of the founders of the "Samourai Wallet", a Bitcoin wallet that is primarily known for its data protection functions. The US Attorney's Office has charged Keonne Rodriguez and William Lonergan Hill with serious charges, including operating an unregistered money transfer business that allegedly processed over two billion dollars worth of illegal transactions and laundered over 100 million US dollars from illegal sources, such as darknet marketplaces. This action also reflects the increased efforts of the US judiciary to regulate and monitor financial activities in the crypto sector more strictly - a kind of clear message to all unlicensed and unregistered service providers.

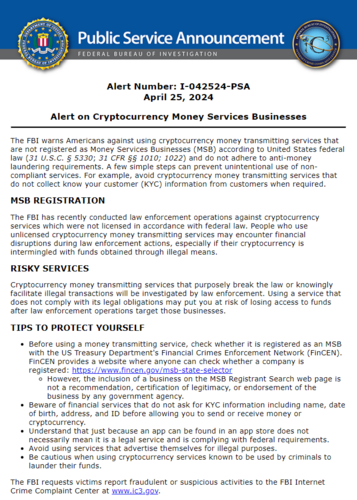

At the same time, the Federal Bureau of Investigation (FBI) has issued a public warning urging US citizens not to use unregistered "cryptocurrency transfer services" that do not comply with KYC requirements. According to the FBI, these services could ultimately be easily misused to conceal illegal transactions. The FBI's warning represents a further step in the consistent stance of the US authorities to further restrict privacy in the crypto industry - always under the pretext of preventing criminal activity. According to the FBI, non-KYC-compliant services pose a high risk as they are often used for money laundering and users could lose access to their funds in the event of law enforcement action.

Cryptocurrency transfer services that intentionally violate the law or knowingly facilitate illegal transactions will be investigated by law enforcement agencies. Using a service that does not fulfill its legal obligations may put you at risk of losing access to funds if law enforcement takes action against these companies. [...] Beware of financial services that do not require KYC information such as name, date of birth, address and ID before allowing you to send or receive money or cryptocurrencies. Understand that just because an app can be found in an app store does not necessarily mean that it is a legitimate service that meets government requirements.

Excerpt from the FBI warning

SEC: "Metamask Wallet is considered an unlicensed broker!"

The conflict between the US Securities and Exchange Commission (SEC) and the Ethereum development company Consensys has recently come to a head. At the center of the dispute is the popular wallet and interface for Ethereum, MetaMask. The SEC accuses Consensys of violating US securities laws by operating MetaMask as an unlicensed broker. MetaMask primarily serves as an interface that allows users to manage, transfer and interact with their Ethereum-based cryptocurrencies. However, the SEC argues that some of MetaMask's features, particularly its staking and swap service, could constitute dealing in securities. In the SEC's view, this requires a broker's license, as such activities could fall within the scope of securities legislation.

Consensys has responded to these allegations by filing a complaint in which it argues that MetaMask does not provide brokerage services in the traditional sense. Consensys argues that MetaMask merely provides a user interface that neither manages clients' assets nor executes transactions on behalf of users. The company emphasizes that MetaMask is not involved in the transfer of assets and therefore should not be considered a broker. Consensys' lawsuit also asks the federal court to declare that Ethereum (ETH) should not be classified as a security. In addition, Consensys is seeking a preliminary injunction prohibiting the SEC from conducting any investigation or enforcement action with respect to MetaMask's swap or staking functions.

This case also raises fundamental questions about the nature of digital assets and the limits of regulatory authority. The decision in this litigation could have far-reaching implications for the crypto industry in the U.S., particularly with respect to how crypto assets and the platforms that facilitate their trading should or must be regulated. The stakes are high, both for the crypto community and for the regulatory authorities who fear for their power and position.

Fear & Agenda

The deeper motivation of governments could actually be rooted in the fear of losing their monetary and fiscal control. Given Bitcoin's massive success story, particularly in its function as a new money and store of value that is independent of government control, this fear does not seem entirely unfounded. Many states are struggling with high debt burdens, and the possibility of citizens fleeing into cryptocurrencies massively undermines the ability of states to effectively reduce their debts through inflation. This phenomenon of financial repression includes measures such as forcing low interest rates and holding government bonds that yield below the rate of inflation in order to reduce government debt in real terms.

An important factor in using financial repression to effectively reduce government debt is to combat alternatives. For example, in the USA in the period after the Second World War, when the nation was able to reduce its debt to a large extent by means of repression, private ownership of gold worth more than 100 US dollars was also prohibited.

A fascinating discussion between the two well-known economic analysts Lyn Alden and Dylan LeClair shed light on precisely this topic. Alden emphasized that fiscal dominance and attacks on privacy and easily transferable assets (so-called "bearer assets") often go hand in hand. This link suggests that government intervention in financial privacy may be partly aimed at preventing flight from traditional currency and thus maintaining control over economic and monetary policy. However, such regulatory measures are often (rightly) criticized, as they not only restrict the freedom and privacy of citizens, but also dampen the innovative potential in society. The balance between necessary regulation and maintaining a dynamic and free economic environment remains one of the biggest challenges for legislators worldwide. While ensuring financial stability and fighting crime are legitimate goals, these must not be used as a pretext to introduce extensive surveillance mechanisms that ultimately undermine financial autonomy and privacy.

They're going to go after self-custody because they need capital controls to properly execute financial repression.

Dylan LeClair 🟠 (@DylanLeClair_) April 25, 2024

Capital is sufficiently captured in walled-garden ETFs.

Widely adopted self-custodial #bitcoin used as a MoE w/ privacy tools present an existential threat. pic.twitter.com/OLefHBKnHH-

Blocktrainer founder Roman Reher also expressed the suspicion yesterday at 𝕏 that fear [of losing power and control] is one of the main drivers for the restrictive approach of the states and the financial system. The battle between freedom and financial repression is in full swing and the coming weeks and months will certainly be exciting. For Reher, however, one thing is certain: "Freedom has already won."

Today was a huge #demonstration of power by the fiat system.

Roman Reher (@RomanReher) April 25, 2024

Remember, they are acting out of #fear... and fear is always a bad advisor.

#Freedom has already won.

They just don't know it yet 🕊️#Bitcoin

Good night🧡-