What are runes?

Guest article

The following article is a guest post. The author of the article is "Freerk", the CTO of the Bitcoin startup "Ordimint". You can find more information about Ordimint's history and goals in → this interview ←.

The Bitcoin halving at block 840000 activated the so-called runs, which have been responsible for high transaction fees ever since. But what exactly are these runes and how are they related to ordinals, inscriptions, BRC-20 tokens, memecoins and the so-called miner death spiral?

What are ordinals?

In the summer of 2022, Casey Rodamor presented his ordinal theory. Using special software, the ord server/wallet, all satoshis - the smallest units of Bitcoin - are indexed. The software determines that certain satoshis are "uncommon" or even "rare". For example, the first satoshi of each block is uncommon, and the first satoshi of a block that is created every two weeks during a difficulty adjustment is rare.

At the beginning of 2023, ord version 0.4.0 also made it possible to add inscriptions - digital inscriptions, so to speak, with which data such as images, MP3s, small videos or texts can be written to the Bitcoin blockchain and linked to an ordinal. This made these inscriptions transferable, which formed the basis for NFTs on the Bitcoin blockchain.

What are BRC-20 tokens?

In March 2023, Domo developed a concept that works in a similar way to the ERC-20 tokens popular with Ethereum, but is based on the Bitcoin blockchain.

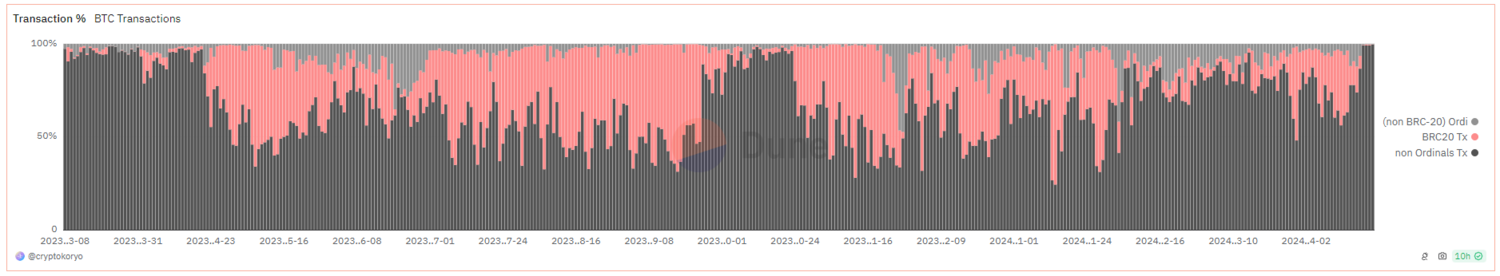

Data is stored in the form of JSON text snippets as inscriptions written to the blockchain. A 'Deploy' transaction defines the ticker symbol, the total number of tokens and the number of tokens created per 'Mint' operation. As the system was not supported by the developers of the ord software, an additional index database was needed to track these tokens. An example of this is Unisat, where these tokens can also be traded. These BRC-20 tokens led to a full mempool and high transaction costs on the Bitcoin blockchain for several months in 2023.

What are runes?

In response to the BRC-20 tokens Runes were introduced by Casey Rodarmor in the fall of 2023 and went live with the Halving Block 840000 on April 20, 2024. Technically speaking, runes use Bitcoin's OP_RETURN function, which allows up to 80 bytes of data to be written to the Bitcoin blockchain. In contrast to BRC-20 tokens, runes are no longer part of the UTXO set as they cannot be spent. Another advantage over BRC-20 is that runes are integrated directly into the ord software and map the entire state on the blockchain without the need for additional software.

How do runes work?

Runes are 'etched' into the Bitcoin blockchain through a so-called 'etching' transaction. There are only a few variable properties when creating runes:

- Name: Must currently be between 13 and 28 characters long. Only capital letters are allowed and the so-called "eye-catching dot" is used as a separator. Every 17500 blocks (approx. 4 months) the name may be one character shorter. The separators do not count towards the character limit.

- Divisibility: Specified in decimal places. The value 1 therefore means a divisibility of 10, the value 2 means a divisibility of 100.

- Premine: Specifies how many tokens are immediately transferred to your wallet during the etching transaction. Some tokens, such as the dog rune, which is distributed by Leonidas (https://twitter.com/LeonidasNFT) to all holders of the runestone ordinal, have 100% premine, so it was never possible to mine these runes yourself.

- Symbol: A single, arbitrary character. The general coin symbol ¤ is used by default, but you can also use €, ₿, ﷽, 💩 or 😭, for example.

- Terms: this includes the "Amount", i.e. how many new tokens are generated per mint transaction; this is a fixed value. Optionally, you can set a "cap", i.e. the upper limit up to which these tokens can be minted by anyone. An absolute or relative start block or end block for the mining transactions is also optional.

- Supply: The supply is calculated from (Cap*Amount)+Premine.

That's it! There are no further options for giving your own tokens any special functionality or defining any other distinguishing features. So the runes can do nothing!

Why are people interested in it?

According to Casey Rodarmor,"fungible tokens are99.9% scams and memes". Even before the Runes and Ordinals, there was already Dogecoin and later Shiba Inu, Pepe Coin, Floki, Wif etc. The boundaries between memecoin and scamcoin are becoming blurred. The currently most popular runes are called SATOSHI-NAKAMOTO, HODL-DIAMOND-DICK, ORDINALS-ARE-DEAD and PEPE-WIT-HONKERS, for example.

Another interesting theory for the success of memecoins and the hype surrounding runes is the "financial nihilism" of Generation Z. Young people can no longer afford a house or condominium anyway, so they gamble: Wallstreetbets, CrYpT0s, NFTs now Ordinals and Runes...

How can I try this out with the Runes?

In the run-up to the Halving, there was already a lot of hype about Runes and many people installed and synced a Bitcoin Fullnode in preparation, installed and synced it in order to be able to etch and mine on the command line in time for the launch. There are now also services for etching and mining, such as via the Xverse browser wallet: wallet.xverse.app/runes/etch or via the okx exchange, where trading is also possible: www.okx.com/web3/marketplace/runes.

Runes can also be traded via the Magic Eden trading platform: https://magiceden.io/runes

Interesting runes can be found on Ordimint.com, for example: https://ordimint.com/runes, where it is also possible to filter the list of runes by premine size (e.g. <5%) and sort by number of mints.

Conclusion

Whether runes have a permanent future remains to be seen. In any case, it can be said that there is a great demand for blockspace just in time for the halving of mining rewards and that the wave of mining company bankruptcies feared at every halving has once again failed to materialize. On the Magic Eden exchange, ordinals on Bitcoin have already overtaken NFTs on Ethereum or Solana. Ordinals and Runes are bringing many people who have mainly played with other cryptocurrencies to Bitcoin.