To explain the properties of good (also: hard) money, this article builds on the "Blocktrainer 1×1 - What is money?". If you haven't read it yet, you can catch up HERE.

As already explained in "Blocktrainer 1×1: What is money?", money is primarily defined by its properties as a medium of exchange, store of value and unit of account. Today's money, which we use in the form of FIAT currencies, is mainly used as a medium of exchange. The term FIAT comes from the Latin word fiat and means: "Let it be done! Let it be done! Let it be".

FIAT money has no - as it is often called - "intrinsic value", as the link to gold was removed in the 1920s and again later in the 1970s. It is only because people trust the state as an authority that they give value to the money that the state gives them.

The first primitive money was intended more as a store of value. Rare shells, animal teeth or gold still show us today what money really was for our ancestors. Namely collector's items.

The properties of good money therefore depend on the quality of the store of value. But what characterizes a good store of value?

In the article "The bullish case for Bitcoin" by Vijay Boyapati, the author describes eight characteristics that make a good store of value. These are:

FIAT money is not a particularly good store of value. Currencies have come and gone with changing governments. The longevity of such a currency is correspondingly weak.

FIAT money can be transferred digitally or as cash. Digitally, transferability is quite high and is only inhibited by government regulations and transfer bans. Cash largely ignores regulations and prohibitions. However, the risk of transportation and storage increases. Accordingly, the transfer is rather moderate.

The issuing institutions are the bottleneck for the fungibility of FIAT currencies. Normally, fungibility is high. However, states can also ensure that exchangeability is completely prevented!

The verifiability of banknotes in the FIAT system is good. Security features make counterfeiting virtually impossible. Despite the latest security methods, however, there is always new counterfeit money that countries have to deal with.

FIAT money is divisible down to cent amounts. This is sufficient for its use case, but compared to eight decimal places for Bitcoin, its divisibility is more in the middle of the field.

The rarity of FIAT currencies is insufficient due to the fact that states (can) reprint money en masse.

Today's FIAT money has existed since the 1920s. Due to constant inflation, the future of FIAT currencies is doomed to be worthless.

FIAT currencies are the exact opposite of Bitcoin. Banks and governments can stop money transfers, intervene to regulate them or prevent them from being used altogether. You can even be prohibited from withdrawing money. The resistance to censorship is poor.

The durability of gold is outstanding! Due to the precious character of the element, it is very resistant to environmental influences.

Compared to Bitcoin and FIAT, gold has poor transferability. Gold has a high weight due to its density. For this reason, gold is also very reluctant to be transported, but remains in a deposit.

Gold remains gold. Whether you melt it down from an ounce and pour it back into a new ounce. The fungibility is therefore good.

Gold can also be forged externally. Investors have already been fooled by gold-plated tungsten. However, analytical methods will always be able to determine that it really is gold. However, the verifiability is rather average.

You can buy gold as bars, coins or combibars. Due to the physical properties of gold, it is difficult to break it down further. The divisibility is therefore moderate.

A gold cube with an edge length of 21.71 meters corresponds to the total amount of gold on earth. This makes gold quite rare. Compared to Bitcoin, the probability that the quantity will change is higher. With Bitcoin, a social, global consensus would have to be reached on changing the maximum amount of Bitcoin. This is easier with gold. Technological advances in space travel could easily produce asteroids containing vast quantities of gold. The rarity of gold is currently still very good but uncertain for the future.

No other store of value has a greater history than gold. Many ancient cultures already saw the value of gold and appreciated its brilliance and durability. The existing history is correspondingly long.

Gold is not regulated in the same way as FIAT money. But due to its nature, gold can be regulated more easily than Bitcoin. Its resistance to censorship is rather moderate.

Bitcoins, like (digital) FIAT currencies, are only records in a database. There is no physical manifestation of them. Their longevity , while unpredictable, is classified as "medium". Bitcoin can only exist as long as the Bitcoin network can be maintained.

The transferability of Bitcoin is very good. Compared to FIAT, no entity can prevent a money transfer. You can carry private keys on your hardware wallet, a device the size of a USB stick, and transport millions of euros at once. In addition, money can be sent instantly to any point on earth.

Bitcoin is very fungible at network level. The blockchain treats all bitcoins equally. However, exchanges cannot accept bitcoins that have been used for illegal purposes. This limits fungibility somewhat.

Bitcoin has the best divisibility compared to FIAT and gold. Bitcoins can be divided to one hundred millionth. So-called satoshis.

Bitcoin is the rarest commodity on earth. Only 0.2% of the world's population could ever own a whole Bitcoin at any one time.

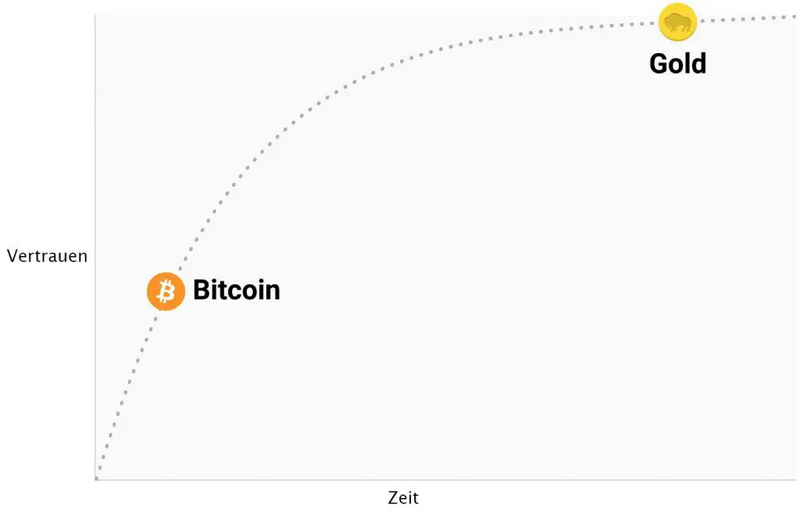

The young Bitcoin has already passed many market turbulences with flying colors. The probability that Bitcoin will disappear again in the near future is therefore correspondingly low. Due to the Lindy effect, society's confidence will continue to grow as Bitcoin ages.

Nevertheless, its current history is weak compared to gold and FIAT money.

No other store of value is more resistant to censorship than Bitcoin. This is what makes the currency so powerful. Bitcoin was not so popular in the drug trade because of its pseudo-anonymity. It is because no entity can prevent the transaction. Its resistance to censorship is correspondingly good.

Bitcoin sets a new benchmark in our existing financial system. With its rare character and resistance to censorship, it can partially invalidate our current financial system. A modernized gold that can store our work in value and does not force us to constantly consume, because we have to fear that tomorrow our money will only be worth half as much. That is Bitcoin.

What do you think are the characteristics of good money? Do you think Bitcoin will change our current monetary system? Discuss with us and write your opinion in our forum.blocktrainer.de.