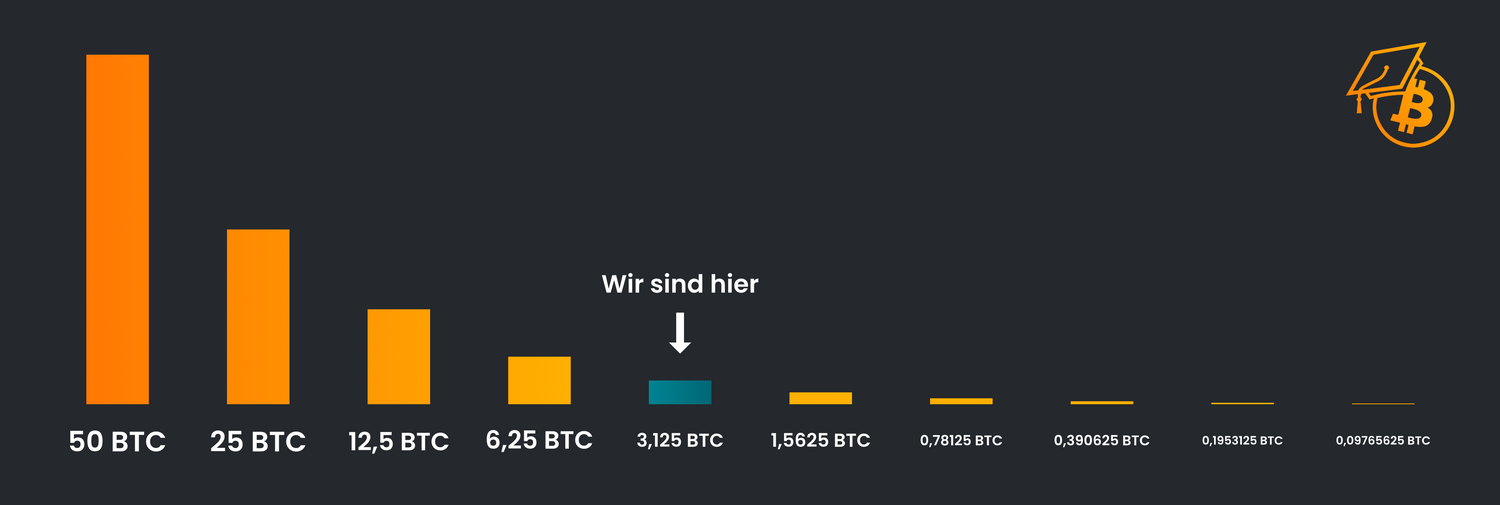

The 4th Bitcoin Halving was successful!

From 6.25 BTC to 3.125 BTC

The 840,000 block in the Bitcoin blockchain was mined tonight, April 20, at around 02:10 (CET), halving the so-called "block subsidy" from 6.25 BTC to 3.125 BTC per new block.

This "halving" only takes place every 210,000 blocks (roughly every 4 years) and was celebrated worldwide by the Bitcoin community as a kind of "New Year's Eve".

How did Bitcoin react?

Although the halving of the block subsidy does not (or should not) have a direct impact on the price, the price and its immediate movements are always looked at during such major events.

In fact, the price did not react at all - contrary to the false statements of some self-appointed "experts" who claimed that the price would halve.

Special features in the block

As with the last Halving block (630,000) or the 666,666 block, there will most likely be some special features and hidden messages in the 840,000 block.

One special feature is definitely the incredible amount of transaction fees paid, totaling ~37.63 BTC (around 2.5 million US dollars). A single transaction was willing to pay a fee of about 430,000 US dollars to get space in this particular block.

There is sure to be some more news on the block in the coming days. We will keep you up to date!

Effects on miners

First of all, halving leads to an immediate drop in income for miners. With operating costs such as electricity consumption and hardware amortization remaining the same, this may become unsustainable for some miners, especially if the price of Bitcoin does not increase to compensate for this decrease. Miners operating on older or less efficient hardware may be forced to cease mining activities as costs outweigh returns. We will be watching how the Bitcoin hashrate develops in the coming days and weeks.

Efficiency will therefore become an even more critical factor in the mining business. Miners who can invest in advanced mining technology that offers a higher hashrate with lower energy consumption will be better positioned to remain profitable even with lower block rewards. Some critics fear that this could lead to further centralization of mining, as large mining operations are more able to take advantage of economies of scale.

Extreme fees could follow!

Historically, each halving has led to an increase in public awareness and active participation in the network, which in turn has led to an increase in transaction volumes and therefore fees. However, this effect could be amplified in the upcoming halving due to additional factors such as the introduction of the Bitcoin Runes protocol and the increasing use of the Ordinals protocol.

The ord inals protocol allows "digital artifacts" to be stored directly on the Bitcoin blockchain by using the space in individual transactions to embed data such as images or text. This practice, which is becoming increasingly popular, leads to a higher demand for block storage space. In particular, the introduction of Runes, a new token standard, has the potential to further increase the demand for transaction storage space. Runes have now been introduced with the Halving block and have already sparked interest and speculation within the community in advance. Some market observers are even predicting transaction fees above 1000sat/vb in the coming weeks!

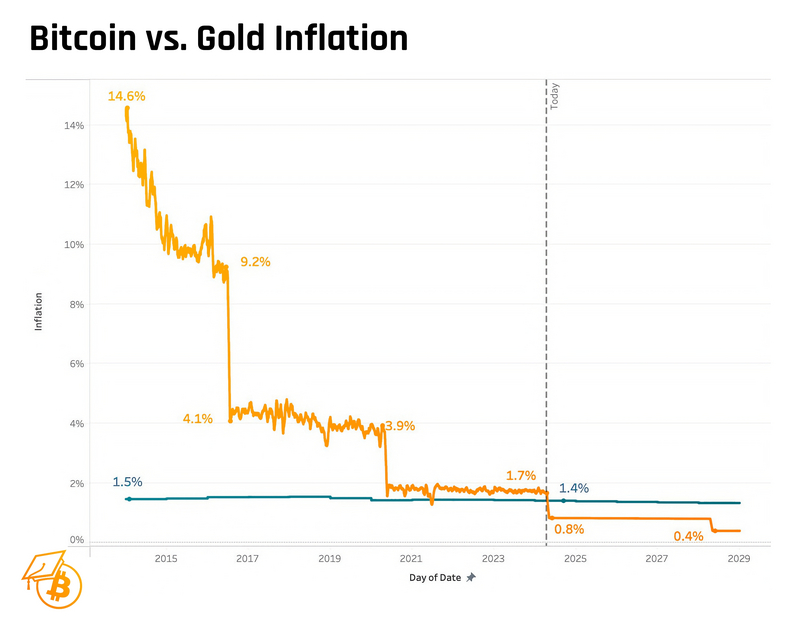

Bitcoin becomes a harder asset than gold

With the 4th halving, the inflation rate of Bitcoin has also halved - from around 1.7% to 0.85%. This means that the proportion of Bitcoin added per year in relation to the amount in circulation to date is now only 0.85%.

This means that Bitcoin has lower inflation than gold for the first time. In the past, the inflation rate of the precious metal has been relatively stable at around 1.5 percent, although a higher gold price increases the incentive to search for it.

Accordingly, from this day on, Bitcoin is the harder money than the precious metal, which had established itself as the money of mankind for many centuries due to its scarcity - at least until US President Richard Nixon "temporarily" suspended the convertibility of the US dollar into gold in 1971.